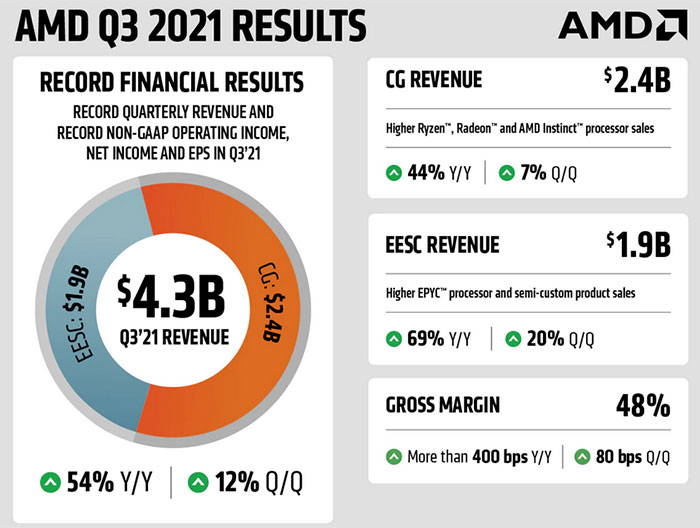

AMD has just published its Q3 2021 financial results. It has achieved record sales, again, and raised full-year guidance, again, for the third time this year. Importantly for investors, AMD beat analyst expectations, and shared a confident strong forecast for Q4. However, great news seems to have been priced-in, as the share price didn't really react in after-hours trading.

Key financials are encapsulated by AMD's natty infographic, shared above. Underlying these results, CNBC commented that revenue was expected by analysts to hit $4.12bn, but was actually $4.31bn (up 54 per cent YoY). Meanwhile, earnings per share were $0.73, vs an expected $0.67, which is up 16 per cent YoY.

"AMD had another record quarter as revenue grew 54 per cent and operating income doubled year-over-year," said AMD CEO Lisa Su in a statement accompanying the results. "Third Gen Epyc processor shipments ramped significantly in the quarter as our data centre sales more than doubled year-over-year. Our business significantly accelerated in 2021, growing faster than the market based on our leadership products and consistent execution."

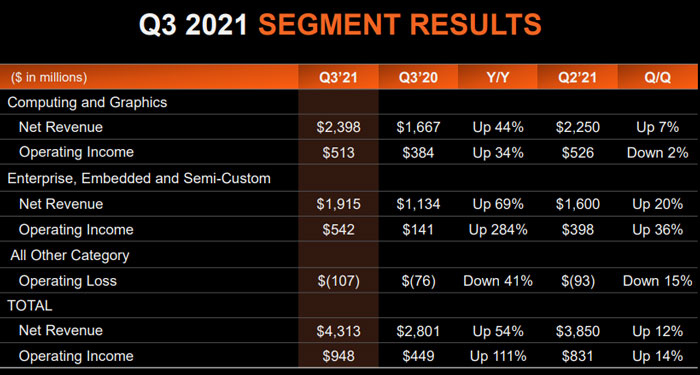

I always like to look at the results broken down by segment, to see if the parts of the business of particular interest to HEXUS readers are performing strongly. In the table above, you can see that Computing & Graphics is indeed doing nicely; with revenue up 44 per cent, and income up 34 per cent. However, the rip-roaring success of the Embedded, Enterprise, and Semi-custom segment, with revenue up 69 per cent and income up 284 per cent, was the highlight of Q3 for AMD.

AMD's EE&SC segment covers its Epyc server ships, Instinct graphics accelerators, and the custom APUs that are used by the likes of the consoles from Microsoft, Sony, and Valve. Consumers are well aware of how fast the likes of the Xbox Series X/S and PlayStation 5 consoles fly off shelves. In the land of servers, Dr Su commented that AMD's data centre sales doubled in the last year, and she was particularly pleased with the "momentum" seen.

The CEO also said that AMD's purchase of Xilinx was making good progress, with the acquisition expected to complete before the end of the year.

Microsoft results too

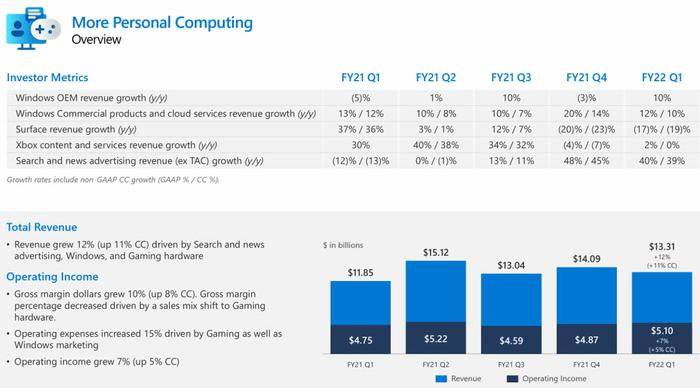

Microsoft published its latest set of financials after the bell on Tuesday, too. It happily beat analyst expectations with revenue growth of 22 per cent YoY. While its cloud business flourished, Microsoft's Surface and Windows OS sales were impacted by hardware supply constraints.

If you are interested in more details, please check out Microsoft's official earnings press release, and/or check out a third-party overview and commentary from CNBC.