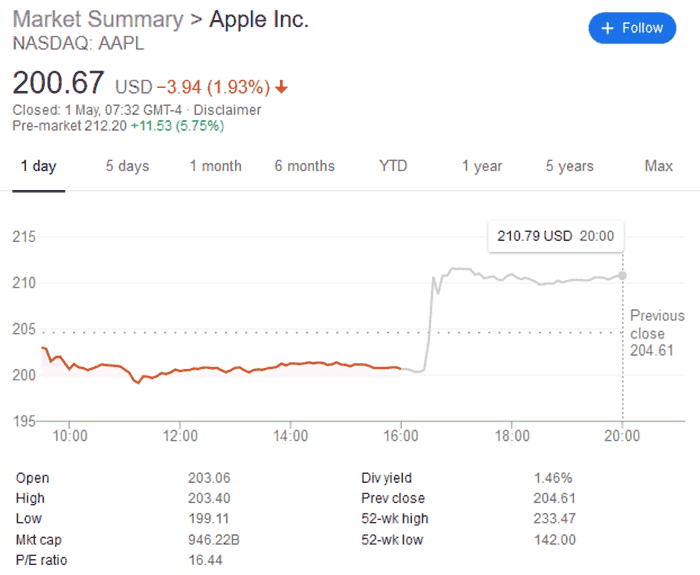

Yesterday evening Apple released its Q2 2019 financials for investors to paw over. Possibly the most interesting take for consumers was that Apple's flagship product, the iPhone, suffered a significant sales decline, with sales down 17 per cent. However, the fact that Apple's long term efforts in services started to pay off handsomely, and a $75bn share buyback scheme was announced, turned investor heads and the firm's shares were up 6 per cent in afterhours trading.

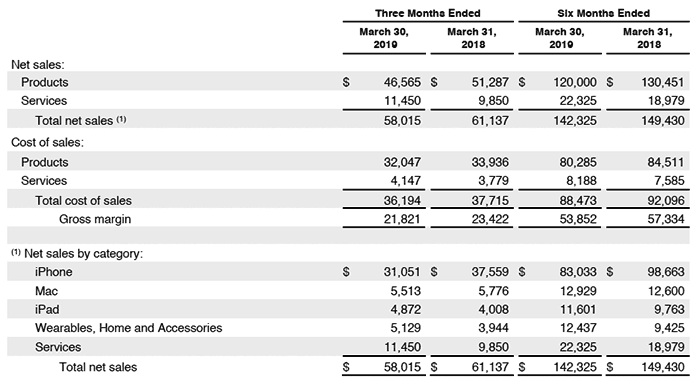

Apple started its press release with the good news - services revenue reched an all-time high of $11.5bn. "Our March quarter results show the continued strength of our installed base of over 1.4 billion active devices, as we set an all-time record for Services," said Tim Cook, Apple's CEO. "We delivered our strongest iPad growth in six years, and we are as excited as ever about our pipeline of innovative hardware, software and services." Cook added that Wearables, Home and Accessories categories were enjoying strong momentum (up 30 per cent) and that Apple is looking forward to sharing more with developers and customers at Apple's 30th annual WWDC in June.

Apple iPad sales have been another highlight of the most recent quarter as they are up over 20 per cent (by revenue). However, the new iPads probably won't have made an impact on these figures as yet. Meanwhile, Apple Mac sales are slightly down at minus 4.5 per cent.

The $11.5bn in cash raised by services may sound like a lot, but for Apple it is in the shadow of the much larger revenue from its iPhones. Thus a similar percentage rise in services doesn't cover the decline in iPhone sales. Apple iPhone revenues were $31.05bn during the quarter, that's 17 per cent down as per our sub-headline. Unfortunately for investors, and news outlets, Apple has recently stopped reporting unit sales of iPhones, which isn't a great sign, but at least we still get to see income from each segment (as shown above). Apple warned of an iPhone sales downturn at the start of the year.

Apple signalled ambitions to expand its services recently (beyond downloaded apps, downloaded and streaming music, and downloaded videos), with the announcement of the Apple Arcade and Apple TV+ streaming services. Apple News+ and Apple Credit Cards were announced at the same time, about a month ago. Apple TV+ will likely be the biggest contributor to revenue in the future but it isn't set to go live until the autumn.