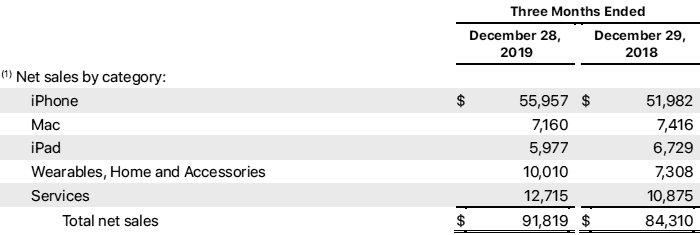

Apple reported its Q1 2020 financials yesterday evening, after the stock markets closed in the US. The good news for Apple investors was that the company reported quarterly revenue of $91.8bn, an increase of 9 per cent compared to last year, and an all-time record. Apple's revenue was quite a higher its own guidance, and significantly better than Wall Street analysts expected. At the time of writing, after investors have had a few hours to get to grips with the finer points of the release, Apple shares are up about 2.8 per cent afterhours.

"We are thrilled to report Apple's highest quarterly revenue ever, fuelled by strong demand for our iPhone 11 and iPhone 11 Pro models, and all-time records for Services and Wearables," said Apple CEO Tim Cook, in a prepared statement. Cook highlighted that the Apple installed user base is now over 1.5bn - and this user base grew in all geographic regions.

Above you can see Apple's revenue in millions, comparing calendar Q4 2019 with the results from a year previously broken down by product category. You will observe the strong increase in iPhone sales, which make up the bulk of Apple's revenue receipts ($56bn of $91.8bn). Meanwhile, interest in iPad tablets and Mac computers continues to dwindle.

Even though Apple has seen success with the latest iPhone 11, I feel it really needs to innovate more to prevent its mobile phones joining the downwards spiralling iPad and Mac hardware. Recently rivals have excited with new form factors, and delighted with slick offerings in the low-to-mid range price brackets.

The Wearables, Home and Accessories category did well to climb above $10bn in income for the most recent quarter. CNBC notes that thanks to this milestone the Apple Watch, AirPods, and Beats headphones products alone could make a 'Fortune 150' company.

Services also grew an encouraging amount for Apple, up 12.7 compared to a year ago. Remember this category includes the likes of Apple TV+, App Store, Music, iCloud and AppleCare.

Apple's guidance for Q2 2020 has been pared back and is bracketed wider than usual due to worries about the potential impacts of the deadly coronavirus.