Commodity prices, stocks, exchange rates and so on may establish pretty reliable trends over extended periods but there are almost always times when the applecart gets upset, at least for a short time. In the computer world we are currently enjoying seeing SSD storage prices and computer RAM modules prices trending to attractive all-time lows for consumers, but there are industry-sourced reports suggesting we could see prices rebound, at least in the short term.

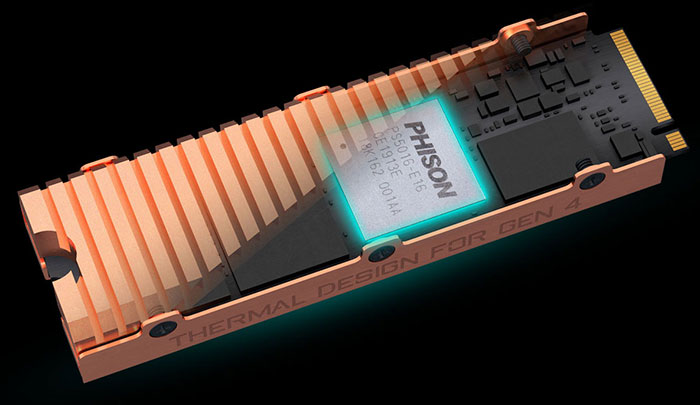

Taiwan's DigiTimes has been talking with its industry sources this week about NAND and DRAM chips, and the products they go into. The journal reports that it has been tipped off that Taiwanese memory module makers like Adata Technology, Phison Electronics and Team Group "are mulling a 10-15 per cent hike in SSD prices and enforcing a limited-supply policy". That doesn't sound good for consumers.

I am not well read in Taiwanese or international business law but the above sounds a bit like anti-competitive collusion, or cartel-like behaviour, in an attempt to maintain or increase prices for consumers. Previous component price fixing behaviour, when uncovered, has lead to fines and so on for the participants. Looking back in HEXUS news archives the most recent action taken against DRAM industry price fixers was by China in 2017. Even further back there have been big fines from the EU for DRAM, CRT and LCD monitor price fixers reported this decade.

Moving further along the DigiTimes report, its industry sources are also seeing "growing expectations that both NAND flash and DRAM chip prices may rebound in the short term". With the intended 10 to 15 per cent SSD price hike added to this rebound, prices could become unpleasantly high for consumer in coming weeks/months.

One has to question the market power of a trio of Taiwanese memory module makers. It is likely far too much to expect the named companies to be able to impact market pricing trends against the forces of global supply and demand - and the existence of other large electronics corporations which will fill the gap if these companies price their wares higher.