The others

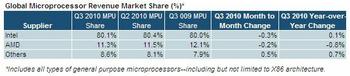

At first glance the latest global microprocessor revenue figures reveal little of interest. Intel's 80 percent share of the general purpose microprocessor market has hardly changed at all in the past year.

But while AMD is clearly holding its own against its giant competitor, it now seems to be losing ground to ‘others'. ISuppli doesn't detail what those others are, but if it's limited to RISC and Itanium server chips, a revenue share of 8.6 percent of all chips seems rather high.

The other possibility is that this survey, accompanied by superficial commentary, encompasses all processors, including ARM-based mobile ones. Bear in mind this is revenue, not volume, and that mobile chips are cheaper than the more powerful PC and server ones. So a 0.5 percent revenue jump from Q2 to Q3 is quite big.

For no obvious reason it's AMD that has lost ground to the ‘others' year-on-year basis, and despite the ‘stalemate' declared by iSuppli, AMD is now in an even weaker position compared to Intel.

"In reality, the share changes in the third quarter from the two incumbents were extremely small and not at all significant," said Matthew Wilkins, principal analyst at iSuppli. "What is significant, however, is that neither company has been able to take any sizable share away from the other. One reason is that each company offers well-matched competitive product portfolios."

"There remains a very competitive situation between the two dominant suppliers. In particular, we look forward to seeing the effect that AMD's forthcoming Fusion products might have on the share situation for these two mega-players."

Total worldwide microprocessor revenues increased by 23 percent year-on-year, which iSuppli reckons is very healthy growth.