We’ll settle for that

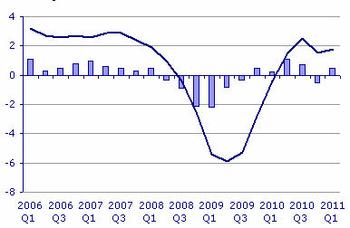

The Office of National Statistics has released its figures for the UK's Q1 GDP, and the good news is they're back in the black after a shock contraction the previous quarter. Two consecutive quarters of negative GDP define a recession, so talk of a double-dip can recede, for now.

GDP grow by 0.5 percent in Q1, having shrunk by the same amount in the previous quarter. While there was relief at the absence of another shock, initial reaction was to point out that the recovery remains weak, and flat.

Q4 2010 is viewed as a bit of an aberration due to the snow in December, which the UK showed its usual complete inability to cope with. With everyone staying at home rather than face Snowmageddon, the services and logistics sectors were hard hit. They rebounded strongly in Q1, more than compensating for the continued decline of the construction sector.

But there are still murmurs of stagflation abounding, as the continued anaemic growth makes it less likely interest rates will be raised in the near future. Inflation remains well above the two percent target and there are few tools available to boost the economy. With government austerity measures starting to kick-in, you have to wonder where the growth is going to come from, especially since we were hardly setting the world on fire before the recession.