AMD has published its Q4 2019 and full year 2019 financials. On the surface the results are very pleasing, with record quarterly and full year revenue headlining the financial presentations. However, delving deeper causes some worries for investors, as does a softened forecast for Q1 2020. Thus, the markets haven't reacted well to the publishing of the results and the AMD share price is down about 5.5 per cent at the time of writing (market closed).

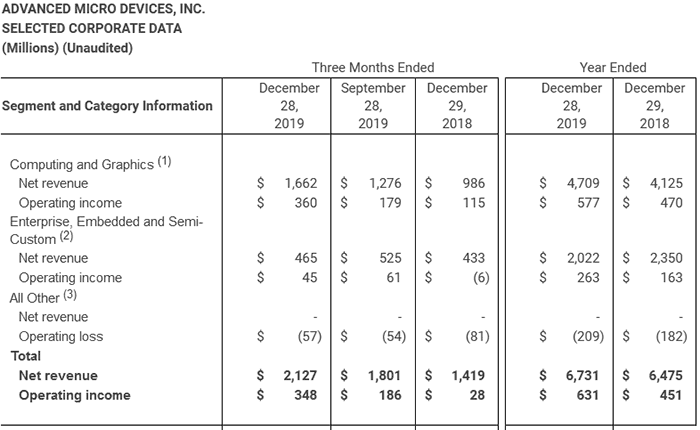

Headline numbers from the newly published financials are that AMD delivered record annual revenue of $6.73bn and increases both gross margin and net income. In Q4 2019 it also enjoyed record quarterly revenue of $2.13bn. In a press release AMD CEO Dr Lis Su was quoted, heralding these results. Putting them into perspective, Su said that "2019 marked a significant milestone in our multi-year journey as we successfully launched and ramped the strongest product portfolio in our 50-year history." She also noted the gaining market shares of Ryzen and Epyc processors, and positive expectations for 2020 and beyond.

AMD reports on two operating segments; the Computing and Graphics segment; and the Enterprise, Embedded and Semi-Custom segment. For the former, the results were indeed very rosy. However, the Enterprise, Embedded and Semi-Custom segment seems to have let the side down with "lower semi-custom sales". This segment's revenue was less than expected by analysts. We all know a great deal of this 'semi custom' business will be driven by seasonal console sales and generations. Right now, in this in-between console generations period, we were bound to see a lull of some kind.

In the post-results analyst call Su was questioned about the fall in semi custom sales and asked to quantify it. According to a MarketWatch report she said that in H2 2019 semi custom sales were down by 36 per cent or more. Furthermore, analysts don't like how AMD doesn't provide specific numbers for chip sales (while rivals Nvidia and Intel do).

Moving onto server chip sales, last week Intel reported surprisingly good results for its Data Centre Group, with CEO Bob Swann saying Intel was growing its market share. Meanwhile AMD says that its YoY income was bolstered by "higher Epyc processor revenue." Both companies are growing market share?

Looking ahead into FY 2020, AMD expects revenue growth of about 28 to 30 per cent across all businesses. Furthermore, AMD confirmed the 7nm Navi refresh, and its 7nm+ next-gen RDNA graphics cards for 2020, in a post-results conference call.