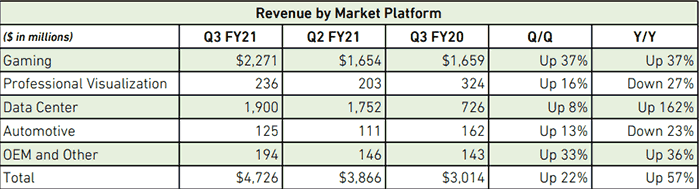

Yesterday evening, after the closing bell, Nvidia released its latest set of financials for investors to ponder over. The results look good with analyst expectations of both revenue and earnings being beaten - but the share price hasn't really reacted in afterhours trading (it is actually down 2 per cent at the time of writing). The biggest news from the financial Q3 2021 results (yes 2021) is that Revenue was up 57 per cent year on year and the company set records for revenue and quarterly profits.

"Nvidia is firing on all cylinders, achieving record revenues in Gaming, Data Center and overall," said Jensen Huang, company founder and CEO. "The new Nvidia GeForce RTX GPU provides our largest-ever generational leap and demand is overwhelming. Nvidia RTX has made ray tracing the new standard in gaming." Huang went on to highlight hat AI and data centre products were also very strong performers, with the new A100 compute platform ramping fast, with the top cloud companies deploying it globally.

Nvidia's business activities are broken down into five market platforms and the accounts include revenue comparisons over time for each one, as I have embedded above. This table is a good one for HEXUS readers as it clearly shows the revenue and trends for Gaming and Pro Visualisation, which are of greatest interest. The great news is that with Nvidia prospering in these activities it will continue to invest in the R&D required to advance its GPU technology.

Q3 highlights in Gaming were obviously the launch of the RX 30 series graphics cards, as well as the introduction of Nvidia Reflex technology for reduced system latency, Nvidia Broadcast AV tech with RTX accelerated AI effects, and the addition of wider support for technologies like real time raytracing and DLSS in PC games.

One last tasty morsel of news from the latest results is that Nvidia says that it expects to complete its $40 billion Arm acquisition in Q1 2022.