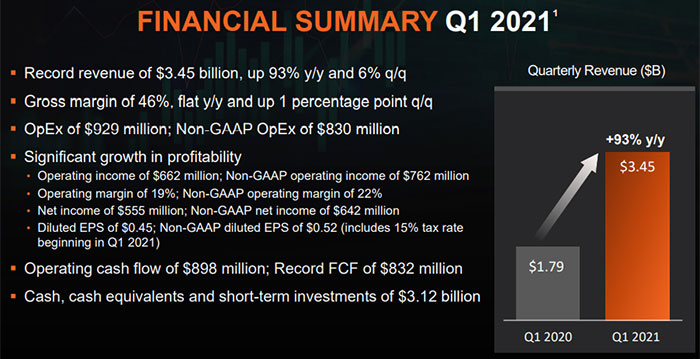

AMD has released its latest quarterly financials, covering Q1 2021, and they show that it is strong and still going places. The scale of the increased revenue was beyond what investors and analysts had been expecting and this, combined with a solid positive outlook, meant that shares are up 3.5 per cent in after-hours trading.

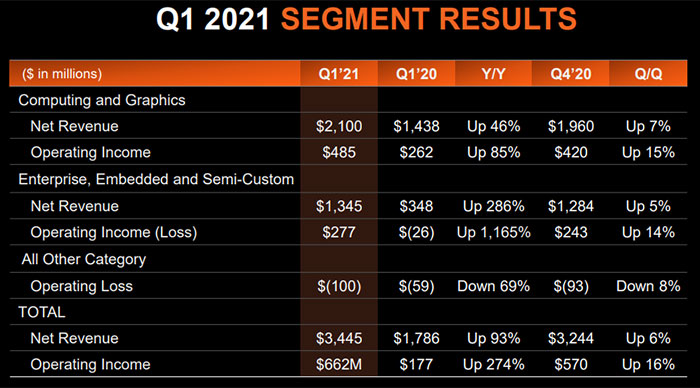

Below you can see a summary chart of the results divided by the business segments AMD operates. Computing and graphics covers all the lovely AMD PC components that HEXUS covers in the news and often appear in our reviews.

Enterprise, Embedded and Semi-Custom covers a rather wide portfolio encompassing server chips and games console chips. Analysts don't like that single number coverage of the server/consoles activity but in an earnings call AMD CEO Dr Lisa Su shared some server business stats to provide greater transparency. Specifically Su said that "In the first quarter, data-center product revenue more than doubled year-over-year and represented a high teens percentage of our overall revenue". Moreover, Su expects the "data-center product revenue to grow significantly as we go through the year".

Compare this data centre business performance with Intel, which last week announced that its Data Centre Group (DCG) revenue was down 20 per cent. Intel execs tried to explain this slump away as the data centre market currently being in a "digestion phase," so were not renewing hardware.

As for AMD's outlook, it is expecting a growth in revenue of 50 per cent YoY. In product terms there are still some major launches in both consumer and enterprise markets to help it push forward. For one thing, we are still waiting for the mass-market friendly RDNA 2 GPUs to flesh out the Radeon RX 6000 series at the lower-end.