NortonLifeLock (formerly known as Symantec Corporation) and Avast have agreed to a merger, in a deal worth between US$8.1 billion and $8.6 billion, depending on Avast shareholder elections. Norton has instigated the merger and will be basically acquiring Avast to create "a new, industry-leading consumer Cyber Safety business". It is interesting to see there is still such a massive amount of money in these businesses, even though the likes of Microsoft has its own built-in virus/malware protection in WIndows, and there is a plethora of other free/affordable solutions on the market.

"This transaction is a huge step forward for consumer Cyber Safety and will ultimately enable us to achieve our vision to protect and empower people to live their digital lives safely," said Vincent Pilette, CEO of NortonLifeLock. "With this combination, we can strengthen our Cyber Safety platform and make it available to more than 500 million users. We will also have the ability to further accelerate innovation to transform Cyber Safety."

The Avast CEO, Ondřej Vlček, talked about the partnership of talent that will be created allowing them to "innovate and develop enhanced solutions and services, with improved capabilities from access to superior data insights". Vlček belives that while global cyber threats are growing, cyber safety suite penetration is very low, offering a good opportunity for the geographically diverse merged brands.

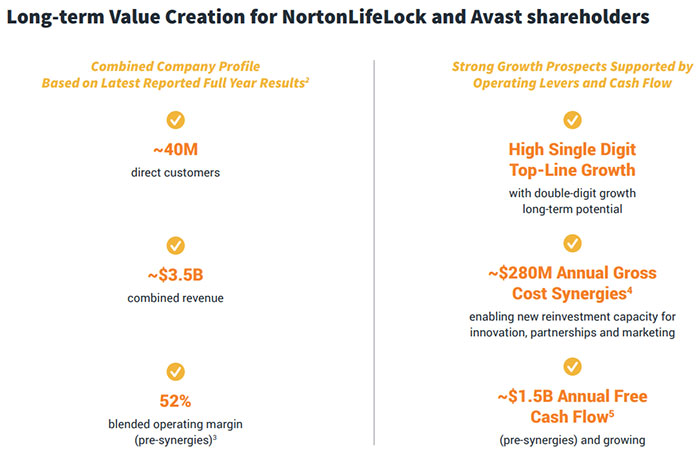

Possibly as important as the wider addressing of the market, it is foreseen that the merger will unlock significant value creation through approximately US$280 million of annual gross cost synergies. Figures reveal that the take-out price is roughly 17 times the yearly earnings of Avast. The newly merged company will have a customer base of 500 million+ users.

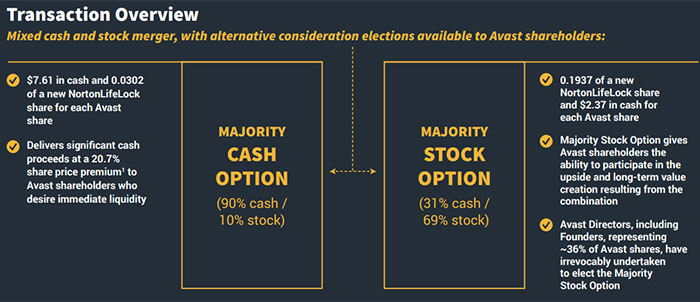

As mentioned in the intro, Avast shareholders have two choices with regard to the buyout; $2.37 in cash and 0.19 in NortonLifeLock shares for each Avast share or $7.61 in cash and 0.03 NortonLifeLock shares for each Avast share. Today, Avast reported revenue of $471.3 million for the first half of 2021, a little above analyst estimates.