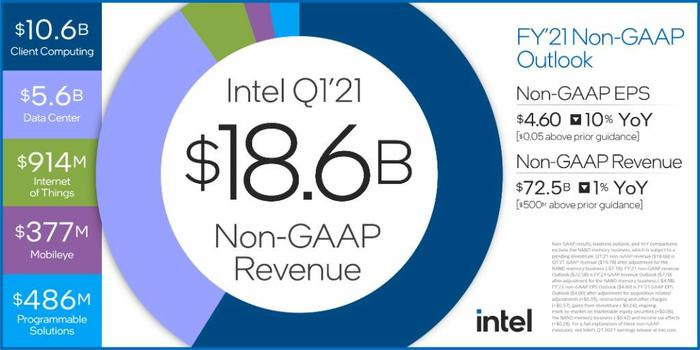

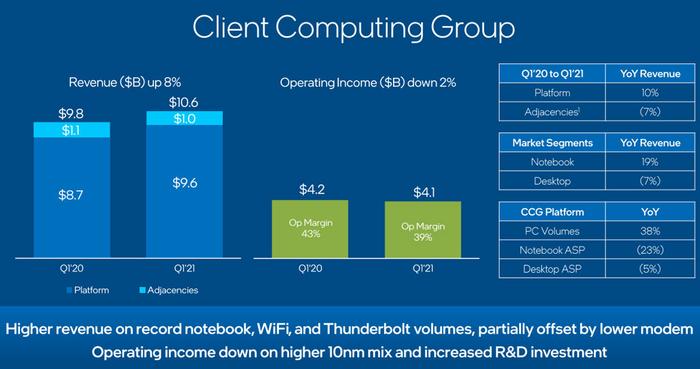

Intel published its First-Quarter 2021 Financial Results yesterday evening. The headline figures and movements can be seen in the infographic embedded below. Highlights are the strength of PC chip sales you can see tallied under the Client Computing Group (CCG) heading. In Q1 21, Intel raked in $10.6 billion from this segment, up 8 per cent year-on-year. However, the markets haven't responded very positively with the share price down about 2.5 per cent afterhours due to a weak outlook for Q2. Another sore point is the slump in the Data Centre Group's (DCG) fortunes (down 20 per cent) and the falling average selling prices (ASPs) of Intel products.

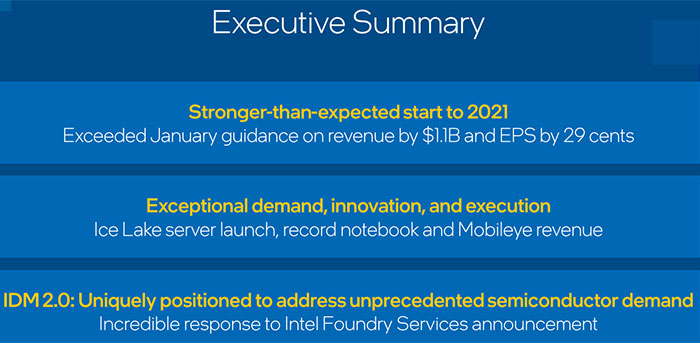

"Intel delivered strong first-quarter results driven by exceptional demand for our leadership products and outstanding execution by our team," Intel CEO Pat Gelsinger wrote in the results press release. Gelsinger reminded interested parties that 2021 is a pivotal year for Intel with the 'Intel Unleashed' plans being executed, "Intel 7nm progressing well," and the firm's IDM 2.0 strategy in place. The teasing of 'jam tomorrow' might have saved the firm's shares from falling further in afterhours, and Gelsinger's reputation and bullish language must be reassuring for long-term holders.

Part of the reason that the CCG might be in some trouble in Q2 is that Intel is still on the back foot – even though it has just released Rocket Lake for desktop. Moreover, its share of laptop design wins is shrinking – regular HEXUS readers will have noted the prevalence of Ryzen CPU laptops recently, especially in the high performance and gaming laptop market.

Lastly, while Intel has a particular strength in that it designs processors and makes them in its own factories, a PC/laptop is not a processor alone. Shortages of other essential components like GPUs, memory, storage and so on will have big impacts on Intel's business, due to the tangled supply chain outside its control. This is expected to be one of the restraining factors in Q2.

Over the last year Intel shares are up 4 per cent, while the Dow Jones Industrial Average (which includes Intel) is up 44 per cent.