PC components research specialists at JPR have worked out that, in the current market, "Bots, scalpers, miners, and speculators," are draining the consumer GPU market by approximately a quarter of all available stock. Sadly, this supply / demand action encourages some of those graphics card sucking groups, but not the widely blamed crypto-currency miners, who would naturally like GPUs to be as cheap as possible.

In a blog post published on Tuesday, Jon Peddie of Jon Peddie Research, provides some background to the current situation, some reasoning about what can be observed from looking at the figures visible on the surface, and some estimates of how many consumer GPUs are getting to gamers, and how many are being used in cryptomining and so on.

It must be said that the current cryptocurrency value boom looks like it still has legs but after looking at the valuation charts more closely, it is really hard to know whether BTC/USD (for example) is currently forming a bullish pennant or approaching a bearish divergence. Then there is the economic / political pressure squeezing it one way or another to contend with…

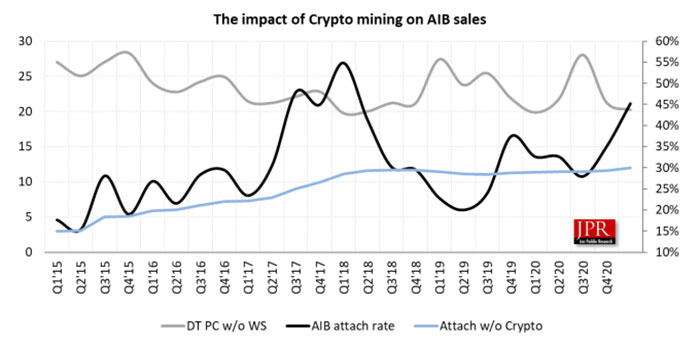

JPR draws the previous crypto boom on a chart showing 'AIB attach rate over time' to give us some insight into what it thinks is playing out. During the previous crypto boom we saw the AIB attach rate edge over 50 per cent, and it is getting near that again. The key reasoning behind JPR's deduction is that "Miners don't buy PCs, so their AIB acquisitions don't follow PC purchases and therefore raise the attach rate. So, our model detects the dedicated mining farms." According to the researchers assumptions and calculations there were thus "approximately 700,000 high-end and midrange," graphics cards bought up by miners and speculators in Q1 2021. The market value of this purchasing power was about US$500 million, reckons JPR.

Where is the escape route from this problem? We feel that AMD and Nvidia's increased supplies of GPUs to partners haven't really helped thus far, and neither have Nvidia's LHR and CMP initiatives. The biggest and fastest change would come if cryptomining with GPUs again becomes a pointless activity - due to the economics of the situation.

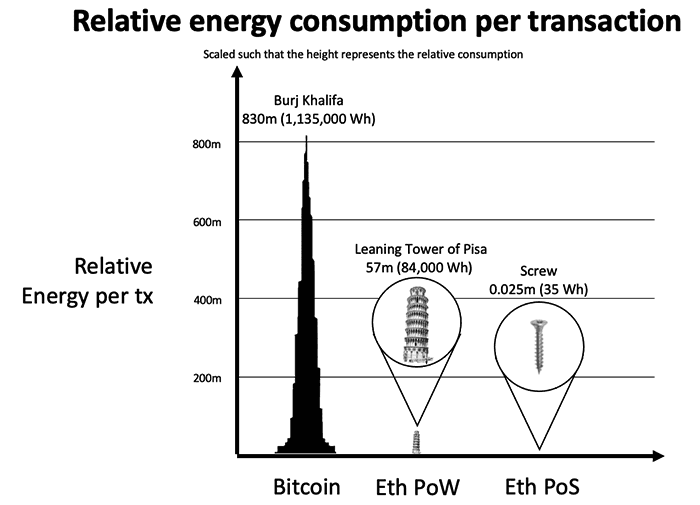

Wishing for a crypto-crash might not be a gamer's only hope though, as cheaper mainstream GPUs like the upcoming desktop GeForce RTX 3050/Ti and Radeon RX 6600 should not really appeal to miners – as long as the red and green teams commit to pump these out in great quantity. On the other side of the equation, a big change is flagged to be on its way as Ethereum transitions to 'Proof of Stake' – drastically slashing energy (GPU) use. In May, the Ethereum Foundation has signposted this change to occur "in the coming months" - sooner would be better.