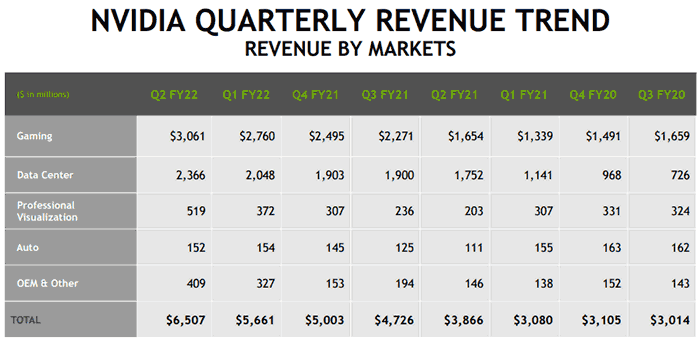

Nvidia has just published its latest set of financials covering the three months leading up to 1st August. The headline grabbing stat is that Nvidia's quarterly revenue broke a record, at $6.51 billion, up 68 per cent YoY, and 15 per cent better than the previous quarter. This figure is the result of record-breaking gaming revenue of $3.06 billion, up 85 per cent YoY, plus record-breaking Data Centre revenue of $2.37 billion, up 35 per cent YoY. Pro Visualisation revenue also grew fantastically, up 156 per cent YoY. Meanwhile, Automotive revenue was up 37 per cent.

Jensen Huang's results statement seemed to focus on AI, scientific computing, automotive… and everything except for gaming, as per usual. You can read his statement here, but let's move onto the gaming segment, which is still Nvidia's biggest revenue contributor. As per the intro and headline, gaming looks like it is doing great for Nvidia. In particular, in its Q2 FY22, the following highlights were noted:

- Introduced GeForce RTX 3080 Ti and GeForce RTX 3070 Ti, delivering up to 50 per cent more performance over the previous generation.

- Announced that Nvidia RTX is featured in 130+ games and applications, including Red Dead Redemption 2, F1 2021 and Minecraft RTX, in China, as well as Adobe Photoshop and Premiere Pro.

- Announced that Nvidia Reflex, which reduces gaming latency, is supported in 20 games, including top e-sports titles.

- Announced that GeForce RTX technologies are available for Arm platforms, with demos of Wolfenstein: Youngblood and The Bistro.

- Announced that GeForce NOW gives members access to more than 1,000 PC games, more than any other cloud-gaming service.

The above isn't all, of course, Nvidia and its partners continued to sell out as many graphics cards as they could produce, with the exceptional market and unprecedented demand we are observing.

From the financials, we don't really know the actual numbers of GPUs supplied and sold compared to other quarters. The boosted revenue will be due to a mix of strong shipments and higher ASPs.

The CFO's commentary on the results (PDF) was most useful to find details about the makeup of graphics card sales. According to this document, 80 per cent of graphics cards sold in the last three months have been RTX 30 LHR versions. However, it is noted that Nvidia upped the supply of its Cryptocurrency Mining Processors (CMP) to help gamers, but CMP didn't do as well as expected. Sales of $400 million worth of CMP cards were expected, but only $266 million realised. Dylan Patel, Chief Analyst at SemiAnalysis, reckons this is due to crypto slowdown. Moreover, he indicates that Nvidia and partners will have reallocated some CMP-targeted GPUs to gaming during the quarter.

Nvidia's shares are up 57 per cent in the last 12 months, and these results look like they will help reverse the 2.15 per cent dip we saw yesterday (NVDA is up 2.3 per cent in afterhours trading).