Nvidia's acquisition of Arm from Softbank for US$40 billion was announced back in mid-September 2020. It was very big news as Arm IPs are so important for the tech industry in general. Thus, the deal and its potential repercussions have been making waves ever since the announcement. In January HEXUS reported on the UK regulator's intention to look closely at the Nvidia Arm deal – remember that Arm is Japanese owned but Cambridge-UK based. Regulators from other countries are also scrutinising the deal, and the US Federal Trade Commission (FTC) is the latest to open an in-depth review of the deal.

The Financial Times reports that the FTC is asking big tech players in the US about their thoughts, and particularly their concerns about Nvidia's acquisition of Arm. Its sources familiar with the review mention Qualcomm specifically. Issues that are likely to cause ire are; that Nvidia could favour its own data centre chip business vs other companies using Arm designs, and Nvidia would get sensitive data about its rivals which often consult with Arm about designs and plans.

Nvidia didn't comment on the FTC investigation, reports the FT. Instead, it trotted out a statement saying that it was "confident that both regulators and customers will see the benefits of our plan to continue Arm’s open licensing model and ensure a transparent, collaborative relationship with Arm’s licensees".

Looking for other reports about Nvidia-Arm, I see that City A.M.'s sources indicate that Google and Microsoft have added their voices of disapproval to the deal going ahead. Like Qualcomm these two tech giants see the acquisition as a big risk to competition.

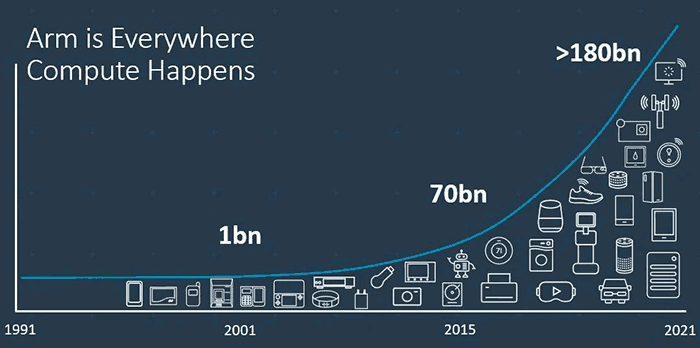

Arm ships about 842 chips per second

Arm recently blogged, alongside its Q4 2020 financials, that it has shipped a record 6.7 billion Arm-based chips in a single quarter. In Q4 last year it shipped 6.7 billion Arm-based chips, which equates to ~842 chips shipped per second. Many of the chips are for IoT and embedded devices, with the Arm Cortex-M accounting for 4.4 billion of that 6.7 billion in the most recent quarter.