According to a weekend report in Japanese financial newspaper, the Nikkei Asian Review, Toshiba and Sony are in "late stage talks," discussing a 20 billion yen ($163 million, £106 million) business deal. Sony is seeking to acquire Toshiba's image sensor operations to gain an even stronger grip on the smartphone, smart automotive, and other image sensor markets.

Toshiba's operations have been put in the spotlight after improper accounting methods were uncovered. Apparently the firm's 'creative accountancy' made the LSI division, which covers semiconductor products and these image sensor operations, look more profitable and important to the company than it is in reality. (Overall Toshiba overstated earnings by $1.3 billion going back to fiscal 2008/09.) With the actual figures now in focus, Toshiba will be restructuring to make the most of its truly profitable operations. That doesn't include image sensors, it seems.

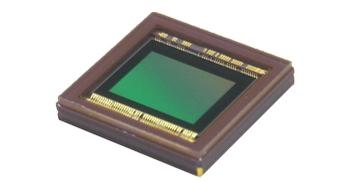

Toshiba TCM5115CL 20MP BSI CMOS imaging sensor

As mentioned in the intro, negotiations are said to be in the late stages. The Nikkei article describes the process as being at an "advanced stage". If the deal completes it is thought that Sony will gain Toshiba's newest production facility in Oita, which can handle 300mm wafers which currently makes CMOS-based components for image sensors, among other things. The sources say that Sony would take over this facility, some employees as well as customer accounts, which include automakers and camera manufacturers.

As part of the deal Toshiba would remove itself from the image sensor market. It would concentrate its profitable/growing semiconductor development activities, mainly in the memory business. Toshiba is a key player in NAND development and collaborated with SanDisk to unveil the world's first 256Gb, 48-Layer BiCS NAND, back in August this year.

A separate, seemingly independent report, by Reuters at the weekend seems to back up the Nikkei report's facts and figures concerning the deal between Toshiba and Sony.